Did I get a retention offer for the Citi Premier card?

The $95 annual fee for my Citi Premier credit card hit in mid-September, so I decided to give Citi a call to see if they could give me a retention offer to offset the annual fee. I was transferred to their agent after going through their automated system and saying that I wanted to cancel my card. As always, the agent asked me why I wanted to cancel my card, and I voiced that the annual fee was too high. I also asked her if there were any retention offers that could offset the annual fee. After putting me on a brief hold, she came back with a choice of one of the following offers:

- $95 statement credit and 1,000 Citi ThankYou Points (TYP) after spending $1,000 per month for the next 3 months

- 5,000 Citi TYP after spending $1,000 total in the next 3 months

I value TYP at around 1.5 cents each, so the 5,000 TYP offer would be just shy of offsetting the annual fee in my opinion. So I decided to go with the first option that straight up offsets the annual fee with the $95 statement credit. It would require more spending, including ensuring that you do hit $1k spend every month for the next 3 months. But now that you get 3x TYP at supermarkets and restaurants with the Citi Premier card, it's a card that you can easily turn to.

Worth keeping the Citi Premier card?

The Citi Premier card has had its ups and downs. In September 2019, Citi gutted most of its best benefits, including the following:

- Car Rental Insurance

- Trip Cancellation & Interruption Protection

- Travel Accident Insurance

- Trip Delay Protection

- Baggage Delay Protection

- Lost Baggage Protection

- Citi Price Rewind

- Return Protection

- Roadside Assistance Dispatch Service

- Travel & Emergency Assistance

- Medical Evacuation

- Missed Event Ticket Protection

That made the Premier pretty much a basic card that you would no longer use to purchase travel and car rentals, even with the 3x earnings potential on travel purchases. But then this past August, Citi revamped the Premier card allowing you to earn 3x on the following categories:

- 3x on airfare and hotels

- 3x on gas

- 3x on dining

- 3x at grocery stores

On top of no foreign exchange transaction fees, this card could be a go-to for your gas, dining, and grocery store purchases. But cards such as the Chase Sapphire and Amex Gold are much better for airfare with their travel protection benefits.

Bottom line

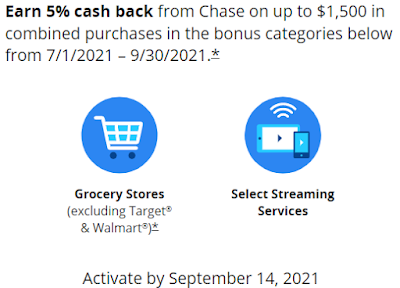

Without a retention offer, it would have been difficult to justify keeping the Citi Premier card. My no annual fee Chase Freedom Flex card gets me 5x on grocery stores for the first year, 3x on dining, and 5x on travel purchases through the Ultimate Rewards portal, so there really isn't a need for me to have a Citi Premier card for the long run. However, the Citi Premier card could still come in useful when traveling internationally as MasterCard has the best foreign exchange rates, and I'll definitely be eating out and grocery shopping internationally. And since I was given a good retention offer, I decided to hold onto it for another year.

From all of us at Flying for Fitness, please stay healthy during this trying time. We hope you enjoyed this post. Please consider visiting one of our sponsors by clicking on the advertisements. Our sponsors pay us for customer visits and help us to keep the lights on. Thanks!

Comments

Post a Comment