New Chase Freedom Flex now open for applications, 5% categories revealed for Q4

9/15/2020 CORRECTION: The Q4 5% cashback category for the Chase Freedom cards includes purchases at PayPal AND Walmart, and not just PayPal transactions at Walmart.

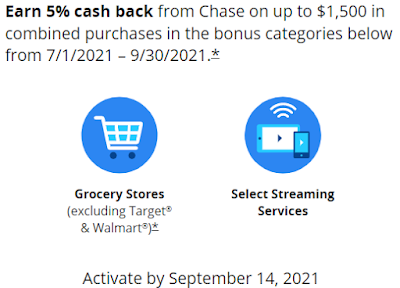

Chase has released its rotating 5% cashback category for the 4th quarter (Q4) for both the new Freedom Flex and Old Freedom (discontinued) cards: PayPal and Walmart purchases. This is one of the more mediocre categories we've seen, although you should still be able to max out on the $1,500 quarterly limit as PayPal is accepted at thousands of online merchants. Q4 runs from October 1, 2020 through December 31, 2020, and you can register here.

New Chase Freedom Flex now open for applications

My referral link for the Chase Freedom Flex

Chase's new Freedom Flex card, which now sets the industry standard for no annual fee cards, is now open for applications. If you have the existing Old Freedom card, you can either apply for the Freedom Flex card and retain both cards, or call Chase to covert your existing Old Freedom to the Freedom Flex. It definitely makes sense to at least covert your card over as there's no credit check for that process, and the Freedom Flex is a much better card with the following benefits (benefits in addition to what is offered by the Old Freedom are highlighted in bold):

- $200 (20,000 UR) sign-up bonus after spending $500 within the first 3 months (new applicants only and not coverts)

- 5% cashback on all grocery store purchases within the first 12 months (new applicants only and not converts)

- Quarterly rotating 5% cashback categories (same as Old Freedom)

- 5% cashback on travel purchased through the Chase Ultimate Rewards portal

- 5% cashback on Lyft rides (same as Old Freedom)

- 3% cashback on dining and drug store purchases

- 1% on all other purchases (same as Old Freedom)

- MasterCard World Elite benefits

- Complimentary DashPass subscription for 3 months (same as Old Freedom)

- 0% intro APR for 15 months from account opening on purchases (new applicants only and not converts)

- Cell Phone Insurance – Up to $800 per claim and $1,000 per year in cell phone protection against theft or damage for phones listed on cardmembers’ monthly bill.

- Satisfaction Guarantee - return protection for up to 60 days for purchases of up to $250.

- Lyft – $10 in credit for every five rides taken in a calendar month, automatically applied to the next ride and capped at once per month.

- Boxed – 5% cash rewards on Boxed purchases for use on future purchases.

- ShopRunner – Free membership to receive two-day shipping and free return shipping at over a hundred online retailers.

- Fandango – Double VIP+ points for movie tickets purchased via the Fandango app or Fandango.com, which can be used towards purchasing movie tickets on Fandango or towards streaming movies and TV shows on FandangoNOW.

- Priceless Experiences, offering activities both digitally and in the cities where they are.

|

| Accidental damage and theft to your cell phone is covered when you use your World Elite MasterCard to pay for your monthly cell phone bill |

- Get the $200 (20,000 UR) sign-up bonus after spending $500 within the first 3 months

- Use your card at Costco since MasterCard isn't accepted at Costco in-store

- Double up on maxing out on the $1,500 limit on quarterly 5% cashback categories

|

| Continue using your Old Freedom card in-store at Costco |

In the past, we have seen Chase include wholesale clubs such as Costco as quarterly 5% categories, so the Old Freedom could still be valuable if you shop in-store at Costco. Costco online does accept MasterCards though, so one way around this may be to just purchase Costco Cash cards online with your Freedom Flex card and use them in store. You may also see yourself surpassing the $1,500 spending limit on quarterly 5% cashback at more popular categories such as grocery stores and Amazon, so having double that limit with both card could be helpful for some.

Comments

Post a Comment