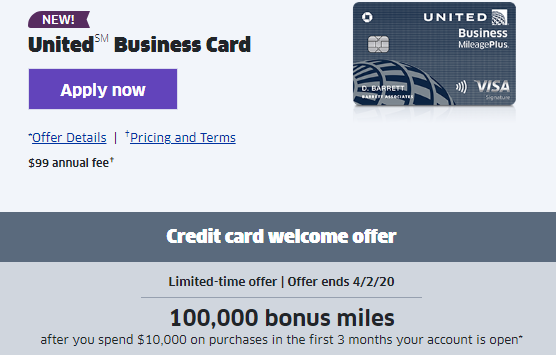

New United Business credit card launches with 100k sign-up bonus

United Airlines has just launched a new business credit card through Chase with a 100,000-mile sign-up bonus after spending $10,000 within the first 3 months of card membership. The new card has a reasonable $99 annual fee, and earns 2x MileagePlus miles on the following categories:

- United Airlines purchases

- Local transit and commuting, including taxis, mass transit, tolls, and ride sharing services

- Gas stations

- Office supply stores

- Restaurants

|

| Redeem United miles for travel on Eva Airlines business class |

You'll also earn 1x on all other purchases. The 2x categories aren't especially industry leading as cards like the Sapphire Reserve earn 3x on all travel (including transit) and restaurants, but it's still good to see the new United Business card include multiple 2x categories including gas stations and office supply stores. The card comes with the following notable benefits:

- Receive 5,000 bonus miles on your anniversary every year when you have both the United Business Card and a personal United Airlines credit card

- Receive a $100 annual United travel credit when you make at least seven United purchases per year, each over $100

- Get two United Club passes every year, both upon account opening, and in subsequent years

- Get a first checked bag free

- Receive priority boarding on United Airlines flights

- Get 25% back on United in-flight purchases

- No foreign exchange transaction fees

The two United Club passes, priority boarding, and first checked bag free are reminiscent of the United Explorer personal card. You will get 5k anniversary miles if you have both cards. The $100 annual United travel credit could also come in handy for United loyalists who make at least seven United purchases a year.

|

| Access United Clubs with the two free annual United Club passes |

Eligibility

This bonus isn’t available to those who currently have the card, as well as current or previous cardmembers who have received a new cardmember bonus on the card in the past 24 months. But since it's literally a brand new card, nobody should currently have the card or have gotten the sign-up bonus within the past 24 months. The card is under 5/24, which means that you won't qualify if you have opened 5 or more credit cards in the past 24 months with any and all financial institutions.

Although it's a business credit card, you don't actually have to own a business in order to be eligible for this card. The thought or plans of starting your own business would technically make you eligible. It's also possible to qualify if you run a part-time side hustle or a freelance gig. You must be a for-profit enterprise, but you might be eligible even if you haven’t turned a profit. Side businesses such as running an AirBNB, selling items on eBay, and even monetizing ads on your YouTube or Blogger account would all in theory qualify as business enterprises.

Bottom line

The new United Business card has an excellent sign-up offer if you're able to meet the hefty $10k in spending in 3 months. Depending on your flying frequency with United, this card may be worth it to hold onto for the long run if you purchase seven or more United flights in a year for the $100 travel credit. You'll also get a free checked bag and priority boarding, which is especially useful in securing those saturated overhead bins.

Comments

Post a Comment